By Amy Bostock

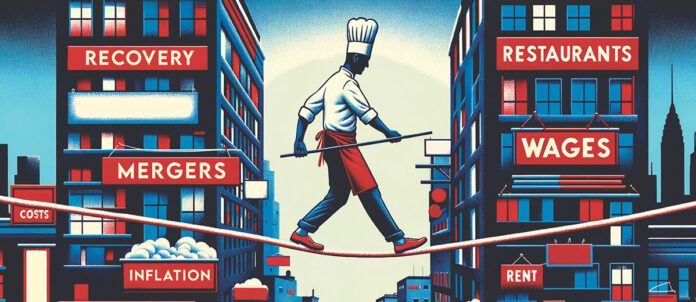

While 2022 saw the foodservice industry surpass the $100-billion mark for the first time, according to Chris Elliott, Chief Economist and VP, Research at Restaurants Canada, there is still instability and uncertainty for Canadian restaurant operators.

“Soaring operating costs — wages, utilities, insurance and rent — have eroded profit margins and created instability and uncertainty for many restaurant owners nationwide,” says Elliott in the Foodservice Facts 2023 released by Restaurants Canada. “The primary source of this volatility within the foodservice industry is that households, businesses, and labour markets, have been, and are still, adapting and adjusting to the aftermath of the pandemic. This has resulted in supply shortages for goods, soaring food costs and record job vacancies, and with Canadians working in home offices rather than onsite, restaurant and foodservice owners are left scrambling to adapt and keep up with the changes.”

In fact, according to the report, based on a survey of restaurant owners, half of all foodservice companies are operating at a loss or just breaking even. “While sales have improved, operators are unable to be profitable due to soaring operating costs and customer traffic that remains stuck below pre-pandemic levels.”

In the company’s 2023 Annual Report, Josh Kobza, CEO of Restaurant Brands International (RBI) — parent company of top-ranked Tim Hortons as well as Popeyes Louisiana Kitchen, Burger King and Firehouse Subs — agreed that challenges are ongoing, stating “during 2022 and 2023, there were increases in commodity, labour and energy costs, which have resulted in inflation, foreign-exchange volatility, rising interest rates and general softening in the consumer environment.”

As a result, once again many operators were hesitant to share sales numbers for our report, resulting in the F&H team having to provide estimates for a number of our listings. And, due to continued mergers and acquisitions, and fewer companies choosing to report sales, our report is now based on the Top 60 operators and not the typical Top 100 operators.

Data Dive

But it’s not all doom and gloom. In his State of the Nation presentation at April’s RC Show 2024, Elliott reminded attendees that Canadians still love going out to restaurants. In fact, “85 per cent of Canadians are purchasing from a restaurant at least once a month. So, despite all the challenges we’ve seen, this number has not changed. And 18 to 24-year-olds are still going out on a weekly basis.”

“The recovery is not done,” said Vince Sgabellone, foodservice industry analyst with Circana during his recent presentation at RC Show 2024. “But at least we’ve crossed the psychological barrier in terms of number of restaurant visits, with the industry up seven per cent in terms of visits versus the prior year.”

He said performance in Canada from a visit standpoint has been “pretty positive” but Circana’s advanced analytics team is forecasting slower growth for the remainder of this year and into next — about two per cent, approximately the same as population growth — as everybody’s pent-up demand “is maybe out of their system.”

So how does all this data carry over to restaurant sales? According to the results of our Top 60 Report, the Canadian restaurant industry once again showed its resiliency in 2023, with the vast majority of the companies listed showing gross-sales growth over 2022. In total, our Top 60 companies recorded estimated gross sales of $41.6 billion for the year ending

Dec. 31, 2023.

Our top four operators — Tim Hortons ($9.6 billion), McDonald’s Restaurants of Canada ($7.1 billion), MTY Food Group ($5.6 billion) and A&W Food Services of Canada ($1.9 billion) — all recorded sales increases in 2023 and finished the year with combined sales of $24.2 billion, up from $20.7 billion at year end 2022. MTY led the pack when it came to growth, adding 328 units (bringing its total unit count for 2023 to (7,116) and growing gross sales by 33 per cent.

“MTY delivered a remarkable financial performance in fiscal 2023 on the strength of record results across the board, including system sales of $5.6 billion,” says Eric Lefebvre, CEO of MTY in the company’s annual report. “Our dual growth strategy, leveraging strategic acquisitions and organic growth, largely enabled us to overcome uncertain market conditions and inflationary pressure during the past year.”

MTY also opened the most locations in the company’s history in the fourth quarter of 2023, bringing it within a few stores of breaking even versus closures for a third-consecutive reporting period. “On the operating efficiency side, we plan to consolidate business units and implement cost-control measures in 2024 to maximize synergies across the entire organization, now that our latest acquisitions are fully integrated within MTY’s operations,” says Lefebvre.

For A&W Food Services of Canada, which ranked fourth on this year’s report with YOY sales growth of $77 million, it was a year of expansion, with 19 new A&W locations opening, bringing the total number of units to 1,054 as of Dec. 31, 2023.

Innovation was the name of the game for the burger chain last year, as it expanded its offerings at the restaurant level.

“In 2023, we continued with the national rollout of the A&W Brew Bar, which offers a variety of frozen beverages as well as hot and cold espresso-based drinks,” says Susan Senecal president and CEO, A&W Food Services of Canada Inc. “Guests can now enjoy the A&W Brew Bar at over 620 A&W restaurants across the country.”

The chain also continued to introduce the Pret A Manger (“Pret”) brand within A&W restaurants in select markets across Canada last year and as of Dec. 31, 2023, five A&W locations (three in Vancouver and two in Toronto) were offering a range of Pret products in their restaurants, with another 20 locations across the country offering Pret coffee and pastries.

Senecal says the company has been focusing efforts on its core strategic initiatives in the last year and believes “our mission together, to excite Canada’s most avid burger lovers, wherever they are, with the best-tasting burgers they crave, earning even more of their visits and making A&W restaurants even more successful’ will help us continue to grow and strengthen our positioning. The talent and experience of our operators and franchisees have contributed significantly to our ability to achieve these goals and our continued success.”

Labour Crunch

According to Foodservice Facts 2023, despite employing more than 1.1 million people, the Canadian foodservice industry faces labour shortages and total employment at restaurants remains 173,700 jobs below 2019 levels.

“Overall, we’ve seen some fairly strong employment growth in Q1 and so far, the forecast is on target,” says Elliott. “We expect 79,000 additional jobs in the first quarter of this year. But then we start to see that soften. So, we’re seeing growth of only about 22,000 jobs, and then actually a contraction in employment. And so, when we start to see those declines, that’s going to lead to higher unemployment rates and that’s going to certainly have an impact on consumer spending and consumer sentiment.”

He says his big concern is “if we start to see a lot of layoffs, then “the economic forecast goes out the window. We see much weaker economic growth and much weaker consumer spending.”

Because of the current labour shortages, he says he expects to see only modest layoffs across the economy.

“Because so many businesses have so many challenges in terms of job vacancies, they’re holding on to staff for dear life. Normally any sign or even a whisper of a recession and businesses start laying off people. But now what we’re seeing is people are holding on to labour, they’re going to ride this out. So that does two things — it maintains employment, but it also helps with the sentiment of the economy and the consumer and people feel more optimistic about spending.”

Looking Ahead

Elliott says in the short term, several economic headwinds will put additional pressure on foodservice operators through 2024. “It’s going to be a difficult 2024, especially in the first half of the year, but things will improve in the second half of the year and into 2025.”

According to Sgabellone, operators are going to have to be innovative in their strategies and aggressive in their planning if they want to get ahead in this new foodservice environment.

“It’s now a steal-share environment,” he says. “If you want to grow, you’ve got to take the customer away from your competitors, because they’re trying to do the same thing to you.”